What’s the Monte Carlo Research to own Retirement?

Content

There are many basic adjustments you to definitely benefits highly recommend to simply help solution the brand new flaws out of Monte Carlo projections. The foremost is to only add on a condo raise to the potential for financial inability the number let you know, such 10percent or 20percent. You’ll find nothing including a concrete existence decide to consider you down. As if you usually get one attention for the particular upcoming mission, your prevent paying attention to the work at hand, miss options that might develop, and stay fixedly using one path, even when a much better, brand-new course might have opened. Join Financial Training, a free of charge 12-day current email address path one explains simple tips to take control of your money, purchase confidently, and you will accelerate their go to be a great multi-millionaire.

Selling Conference 2025

Having fun with Robert Shiller’s investigation time for 1871, we could explore a good Shapiro-Wilk test to examine if yearly output showcase a statistically high deviation of a normal delivery – and the results recommend they don’t. Put simply, if you are there is “weight tails” regarding the short-name (every day otherwise monthly) get back investigation, it averages out by the end of the season. A good Monte Carlo analysis try a hack which is used inside many different medical and sociological sphere.

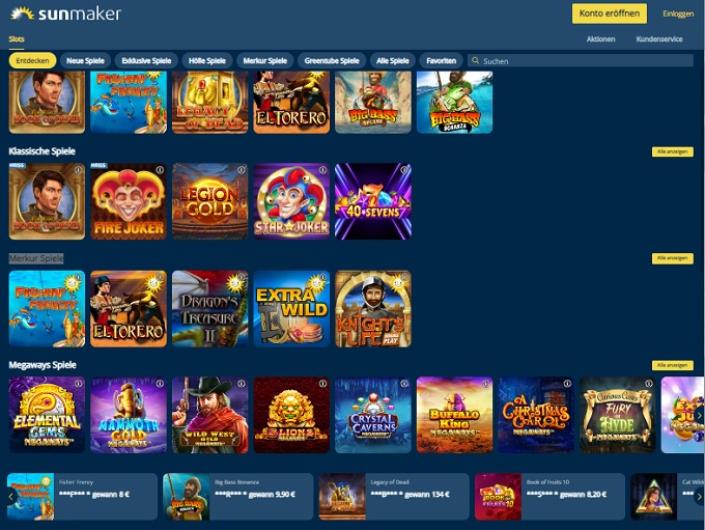

Stop the new Micro EPT Monte Carlo Show for the a premier That have a pleasant Extra

After you come across philosophy for every of one’s 1st inputs, you could work on a great deterministic calculation to decide when the you can work with away from currency one which just perish otherwise, otherwise, how much money you should have once you pass away. But really, a review of actual-community market research implies that it isn’t truly the situation. Rather, field production appear to display at the least a couple of other fashion. They’lso are extremely greatly determined by a few years of later years. For many who go through the worst-circumstances condition, you’ll observe that it has an awful first 12 months. Then ages aren’t while the bad, but one to first 12 months is the perfect place it all goes wrong.

By the sticking extra standards for the a retirement considered calculation. Of numerous monetary https://happy-gambler.com/the-lost-princess-anastasia/ planners play with 29-season standard deviations to check on the new asked price away from get back to the old age forecasts. Standard Departure is a way of measuring volatility (elizabeth.grams., good and the bad) from investment production.

One of the greatest threats in the retiring is known as an excellent “sequence away from return exposure.” The brand new succession away from go back exposure is the proven fact that the new buy the place you get certain efficiency is essential. When you have currency invested in an asset that’s expected giving an 8percent annual get back, that does not mean that it will earn 8percent yearly. Rather, it could be upwards twenty fivepercent in a number of many years and off tenpercent in other years. The new 8percent contour is the undeniable fact that more a long period out of date, the new expected annual price away from come back is 8percent (not to mention, one to get back isn’t guaranteed). Somewhat, even though, usually a 4.08percent first withdrawal price is a lot of. Whenever we assume that the brand new retiree usually requires one 40,766 out of initial using and you may changes per then 12 months to own rising cost of living, i end up getting the next list of wealth outcomes.

- Once more, the real bad-instance historic condition with this particular using rates nonetheless survived to own 30 decades.

- But so it “upside exposure” is not the you to definitely many people are concerned with.

- Monte Carlo simulations gives a clearer picture of exposure, such whether an excellent retiree tend to outlive the later years offers.

- 5,556 of that goes to your taxation and you can costs, and you can 50,one hundred thousand create go to your annual using.

Monte Carlo simulations will offer a clearer image of exposure, for example whether or not an excellent retiree tend to outlive the retirement deals. There is absolutely no foolproof treatment for predict the long run, but a good Monte Carlo simulator that allows for the real opportunity from disaster will offer a sharper image of what kind of cash so you can properly withdraw away from old age deals. Historically, a score away from 95percent+ is safe sufficient to history the current period in just about any prior situation. A score from 90percent has been most safe historically – about equal to in the a 4percent detachment rates. The new Minafi Old age Simulation try a Monte Carlo Simulation athlete to possess retired people to understand potential futures based on historic output. The brand new discharge of WPT International means that poker people inside the world actually have the ability to win their treatment for WPT events, winnings awards and luxuriate in exciting game such as Web based poker Flips.

Better On-line poker Bedroom

You to can be what we remember as the utmost important rider. In early section of it century, indeed there wasn’t much going on. It actually was however quite definitely a business stage to own innovation you to definitely didn’t features commercial usefulness. A whole lot happened between 2010 and 2015 regarding the newest systems, which led to incredibly enjoyable the fresh organizations.

For individuals who retire best in the event the stock exchange or discount suffers a continual downturn, which can devastate your finances and you will dramatically enhance the odds you to your bank account cannot last (you’d basically become attempting to sell reduced instead of an opportunity for you to definitely fill up your retirement coffers). Running a Monte Carlo simulation can help you choose just how almost certainly you are to-fall target on the series out of go back chance. And therefore change is specially extremely important considering the preferred inclination from monetary advisers to attenuate much time-term go back assumptions as a way out of adjusting to own Monte Carlo’s sensed understatement from end chance. We are able to rating a sense of if or even just what the amount Monte Carlo analysis understates much time-name tail risk relative to actual historical production because of the indeed contrasting her or him in the front side-by-front later years forecasts.